A payslip is a fundamental document that outlines an employee’s earnings, deductions, and other financial details. It serves as a crucial tool for both employees and employers, ensuring transparency, facilitating accurate record-keeping, and safeguarding workers’ rights. In Turkey, payslip edition is subject to specific regulations that aim to protect employees and promote fair practices. This article delves into the importance of payslip edition in Turkey, explores the key regulations surrounding it, and highlights its significance in maintaining a harmonious employer-employee relationship.

- Ensuring Transparency and Compliance:

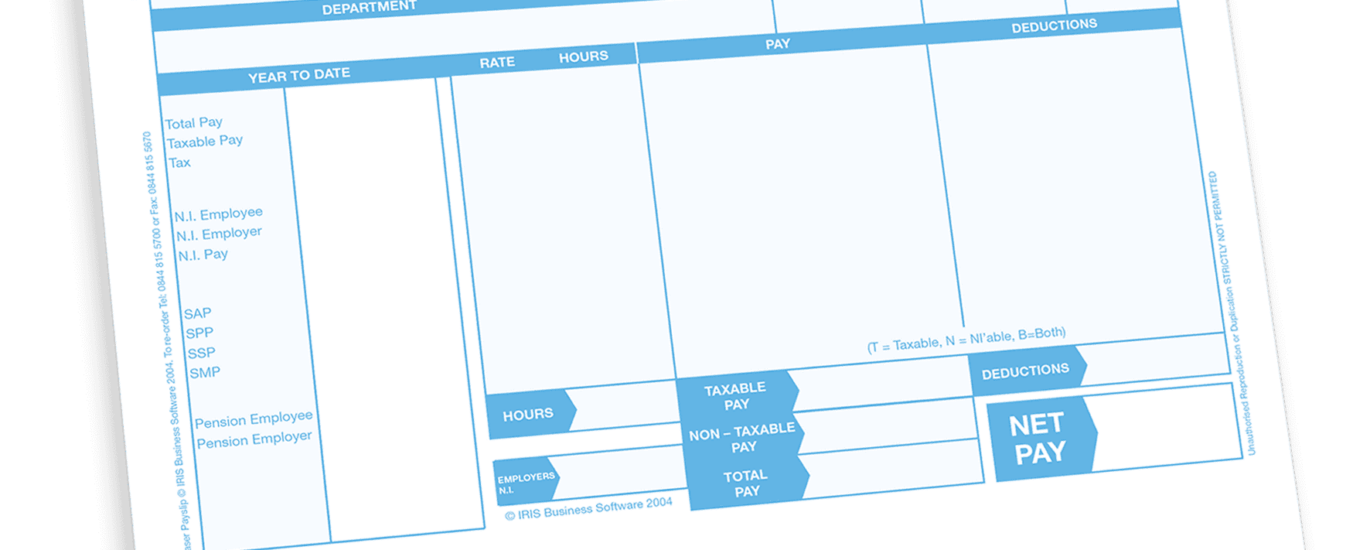

Payslip edition plays a vital role in promoting transparency and compliance with labor laws in Turkey. According to the Turkish Labor Code, employers are legally obliged to provide employees with detailed payslips containing specific information. This includes the gross salary, deductions, allowances, bonuses, overtime pay, and any statutory contributions made on behalf of the employee, such as taxes and social security premiums. By providing this comprehensive breakdown, payslips enable employees to verify the accuracy of their payments and ensure compliance with legal requirements.

- Protecting Employee Rights:

The edition of payslips is a critical mechanism for safeguarding employee rights in Turkey. It provides employees with tangible evidence of their wages, ensuring they receive fair compensation for their work. Payslips also serve as a means to prevent wage theft, unauthorized deductions, or underpayment, as employees can compare their payslips against employment contracts and relevant labor laws. Additionally, in case of disputes or legal claims, accurate and updated payslips serve as essential evidence to support employees’ claims and protect their rights.

- Facilitating Financial Planning and Budgeting:

Payslip edition is invaluable for employees when it comes to financial planning and budgeting. By clearly outlining the income and deductions, payslips empower employees to track their earnings, understand their tax liabilities, and plan their finances effectively. It enables employees to make informed decisions about savings, investments, and expenditure, ensuring a more stable financial future. Moreover, the consistent provision of payslips aids employees in monitoring their career progression and evaluating the impact of any salary changes or benefits.

- Tax Compliance and Reporting:

Accurate payslip edition is crucial for both employees and employers in meeting their tax obligations in Turkey. Employers must calculate and withhold the appropriate amount of income tax from employees’ wages based on the prevailing tax regulations. The detailed breakdown in payslips enables employees to understand their tax liabilities and comply with tax reporting requirements. Similarly, employers rely on payslips to accurately report and remit payroll taxes on behalf of their employees, ensuring compliance with tax laws and avoiding penalties or legal issues.

- Record-Keeping and Auditing:

Payslip edition serves as a crucial record-keeping tool for employers, facilitating efficient payroll management and ensuring compliance with auditing requirements. Employers are required to maintain accurate records of payslips for a specified period, typically up to five years, as mandated by Turkish labor regulations. These records provide a clear audit trail and help employers in responding to inquiries from tax authorities, labor inspectors, or other relevant entities. Proper record-keeping also promotes accountability and transparency within organizations.

- Online Payslip Edition:

In line with technological advancements, many organizations in Turkey are transitioning to online payslip edition systems. This shift offers numerous benefits, such as convenience, accessibility, and enhanced data security. Online payslips allow employees to access their payment information anytime, anywhere, eliminating the need for physical document storage. It also reduces administrative burdens for employers, streamlines the payslip generation process, and minimizes the risk of human error. However, employers must ensure the protection of employees’ personal and financial data in accordance with data privacy laws.

Conclusion:

Payslip edition holds significant importance in Turkey, promoting transparency, compliance, and fairness in the employer-employee relationship. By providing detailed information on earnings, deductions, and statutory contributions, payslips empower employees to verify the accuracy of their payments and protect their rights. Furthermore, payslips facilitate financial planning, tax compliance, and efficient record-keeping for both employees and employers. With the advent of digitalization, online payslip systems offer added convenience and security. Adhering to the regulations surrounding payslip edition in Turkey is crucial for fostering trust, accountability, and a harmonious working environment between employers and employees.