Payroll in Turkey benefits foreign companies for several reasons. Turkey is an important consumer market. 80 million people live in this country and the GDP is $141,789 million. Prestigious business hubs are located in Turkey, such as Istanbul, Ankara and Izmir. In the past few years, Turkey has emerged as a global, economic and political power.

Doing business in Turkey

The International Monetary Fund (IMF) has defined Turkey as an emerging market economy. According to specialists, Turkey is among the world’s developed countries. This country is also industrialised (19th in nominal GDP). In sectors such as agricultural products, textiles, transportation equipment and consumer electronics, Turkey is one of the leading producers.

In 2018, the Turkish lira lost much of its value. There was a clear crisis and the Turkish economy had several issues, such as loan defaults and high inflation. A current account deficit caused the crisis, and president Erdogan’s ideas are clearly unorthodox regarding interest rate policy. Currently, growth is back and Turkey has started to perform again.

Why invest in Turkey

Turkey is an investment target, and plenty of reasons prove this.

Turkish business is strong, the country has the world’s 17th largest nominal GDP, and Turkey is considered a developed country. Several economists and specialists describe Turkey as a newly industrialised, emerging market country.

A pool of highly skilled employees and graduates are available if you wish to do business in Turkey. Business institutions are modern, and the country values productivity. These arguments push encourage companies to choose Payroll in Turkey solutions.

Natural, abundant resources are present in Turkey which contribute to the country’s economic strength.

Advantageous global trading is possible thanks to its global location, bordered by the Middle East, Turkey connects to a new and fresh market.

Regarding research and innovation, Turkey has realised significant technological and scientific achievements. In a fertile business environment, products are developed and there is significant foreign investment in Turkey because the country is open. Several investment opportunities exist for foreign investors in this lucrative market.

How to register a company in Turkey

Turkey and its dynamic economy attracts many foreign investors. Straddling two continents, it represents the gateway to lot of companies from Asia and the Middle East to Europe. The country has many agreements with the European Union, which allow easier exchanges with European partners.

Tourism is a highly developed sector which provides significant revenue. Turkey has good infrastructure and a skilled workforce at competitive costs, with flexible labour laws. The legal framework is similar to Europe. All of these reasons make Turkey an ideal country to establish a business, but how to do it?

Legislation that encourages investment and Payroll in Turkey

Foreign investors are treated equal to Turkish investors. The creation of businesses by foreigners has recently been facilitated by the reforms of the Commercial Code of June 12th, 2012, which allows foreign investors to enjoy tax advantages. The place of residence does not matter as long as the registered office is located in Turkey, but an address is essential for legal reasons.

Setting up a company can take only one day if all the documents are provided to the Chamber of Commerce, which then grants the status of a legal entity.

However, the steps to follow depend on the type of company and the type of activity that the company will carry out. With the new laws, investors are now exempt from submitting to the authorisation of the Ministry of Science, Industry and Technology.

The shareholding structure has changed, and henceforth joint stock companies and limited liability companies (LLCs) may consist of a single member. Previously, the joint stock company had to bring together at least five people, and the LLC at least two.

At present, the board of directors can also be made up of a single person who need not necessarily be a shareholder. In addition, physical presence of the members of the Board is not compulsory.

Intellectual property rights can be used as capital in kind, and it is sufficient that the funds are transferable and can be converted into cash value.

Business transactions carried out outside their field of activity are now legal.

In early January 2012, laws were passed to make it easier for foreign companies to buy real estate.

Simple steps

All formalities must be carried out in Turkish by a notary and they must comply with formal requirements: The company’s articles of association must mention information such as the legal form, the duration, the company name, the registered office, corporate objectives, distribution of share capital and the legal representative of the company. A Turkish bank account must be opened to deposit the minimum capital required for the creation of a company, which varies according to the type of company.

That said, business creators often face difficulties due to sometimes inefficient Turkish bureaucracy and a slow judicial system. Turkey is at the mercy of imports of hydrocarbons and therefore price variations. The exchange rate of the Turkish lira (TL) is also very variable.

What are the advantages of Payroll in Turkey ?

This article follows an email our team received from a recruiter asking us what was the point of using a consultant in Payroll in Turkey. Note that Payroll is an alternative “recruitment in Turkey” (please visit our Turkey HR expertise link) method, that is not new but is expanding. Recently, the Turkish government announced that it wanted to make Payroll in Turkey a tool to reduce structural unemployment. This is normal since its status is widespread among consultants with solid professional experience and skills.

We mainly find Payroll in the fields of training and intellectual services. However, before addressing the advantages of Umbrella in Turkey for a company, it is necessary to provide a definition.

To put it simply, Payroll in Turkey is an alternative solution to setting up a business (for an individual or company). A person who is under Umbrella company based in Turkey can operate as self-employed on his/her own account, while benefitting from the social status of an employee. The particularity of Payroll solution is that it is based on a service contract between you (the client who offers services), the provider and the Payroll company.

You find experts

Payroll in Turkey meets a specific need that you have in business. But not just any need, since this is about finding an expert consultant, someone who will really bring added value to your organisation. The employees carried have solid skills. This type of profile is generally found in the auditing, management, industry, engineering and even project management sectors.

You know exactly how much your expert costs you

You negotiate the content, the amount and the duration of the service, directly with the consultant of your choice, and thus respect the budget of your projects.

You have no social commitment with the employees

Here, you contract intellectual services according to your need, through a simple commercial contract. There is therefore no commitment to an employment contract and the expert benefits from employee social protection in Turkey, in addition to his/her remuneration.

Various Employment Contracts that are possible in Turkey

Turkish Labour Law and Trade Union Law are quite strict. They clearly define various types of employment contract. You’ll find below, a different version available according to your configuration:

- Work contracts for “temporary” and “permanent” employment

- Work contracts for a “definite period” or an “indefinite period”

- Work contracts for “part-time” and “full-time” employment

- Work contracts for “work-upon-call”

- Work contracts with a trial period

- Work contacts constituted with a team contract

Working hours and overtime arrangements

According to Turkish Labour Law, weekly working hours are limited to 45 hours, it is the maximum possible. Normally, 45 hours must be defined equally during a working week, but, a more flexible arrangement is also possible with employer according to configuration and the project. A solution must be agreed between employer and employee within the legal limits.

As a rule, hours exceeding the limit of 45 hours per week are accepted as “overtime hours”. The total number of overtime hours worked per year may not exceed 270 hours. The application of the overtime work is separately determined through an internal company regulation.

Cost of Employment contract termination in Turkey

Extract of Turkish law about indemnity (according to each employee, it may change and must be adapted)

It is specified concerning termination cost for employer in Turkey:

– Each employer must support severance pay for a fixed term contract. In case of permanent contract, severance benefits must be supported too.

– Severance pay (“kidem” in Turkish): Corresponding to one (1) month salary (including all extra expenses for an employee, like meals, bonus, travel allowances etc.) per seniority year (for example, for 3 years seniority, employer will have to pay 3 months of salary to his employee).

– Severance benefits (“inbar” in Turkish): There is a prior notice to respect before terminating a work contract in Turkey. It corresponds to:

o Two (2) weeks (if the employee has a seniority between zero (0) and six (6) months)

o Four (4) weeks (between six (6) months to one and a half (1.5) years)

o Six (6) weeks (between one and a half (1.5) year to three (3) years)

o Eight (8) weeks (over three (3) years).

– In Turkey, in order to terminate a fixed term work contract with an employee, the employer will have the choice to:

o Either to terminate it immediately and pay severance benefits

o Or to respect notice period until last day.

Income Taxes:

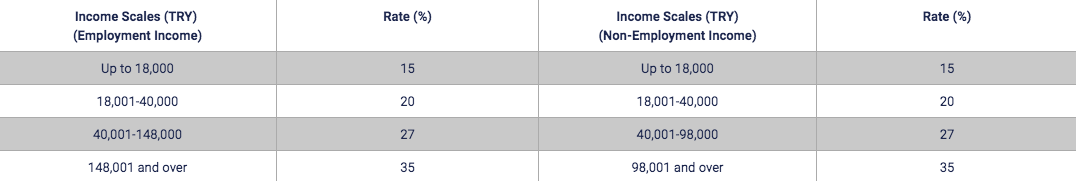

Individual income tax rates vary from 15% to 35%. Individual income tax rates applicable are as follows:

For Income Scales (TRY) (Employment Income) Up to 18,000 the rate is 15%.

Between 18,001 and 40,000 the rate is 20%.

Between 40,001 and 148,000 the rate is 27%.

From 148,001 and over the rate is 35%.

For Income Scales (TRY) (Non-Employment Income) up to 18,000 the rate is 15%.

Between 18,001 and 40,000 the rate is 20%.

Between 40,001 and 148,000 the rate is 27%.

From 148,001 and over the rate is 35%.

Social security premium rates are as follows:

Employee’s share:

- Short-term

- Disability, penalty and death risks: 9%

- General Health Insurance: 5%

- Unemployment Insurance: 1%

- Total: 15%

Employer’s share:

- Short-term: 2%

- Disability, penalty and death risks: 11%

- General Health Insurance: 7.5 %

- Unemployment Insurance: 2%

- Total: 22.5%

Total: Employee’s and Employer’s share:

- Short-term: 2%

- Disability, penalty and death risks: 20%

- General Health Insurance: 12.5 %

- Unemployment Insurance: 3%

- Total: 37.5%

Our company, Beverly Associates supports you with both HR and Payroll in Turkey. Please contact us with any further questions.