While making explanations on wages, it is also necessary to mention the minimum wage institution in Turkey, which has a significant impact on the size of the country and imposes certain obligations on the employer.

Regulations on minimum wage in Turkey are included in Article 39 of the Labour Law No. 4857, and the Minimum Wage Regulation, which entered into force after being published in the Official Gazette dated 01.08.2004 and numbered 25540, was issued on the subject.

Article 4 of the Regulation stipulates that the minimum wage in Turkey, which is defined as the wage paid to workers for a normal working day and which is sufficient to meet the minimum level of the worker’s compulsory needs such as food, housing, clothing, health, transportation and culture at the prices of the day, shall be determined by the Minimum Wage Determination Commission at the latest every two years in accordance with Article 39 of the Law. However, in practice, due to general economic conditions, it is usually determined annually or even in 6-month periods.

The provision of the Law recognises the decisions of the Commission as final and stipulates that the decisions shall enter into force upon publication in the Official Gazette (as of the first day of the month following the date of publication as per Article 11 of the Regulation).

According to Article 6 of the Regulation, the minimum wage in Turkey must be determined on a daily basis for all sectors of labour.

Article 12 of the Regulation introduces a number of employer obligations in relation to the minimum wage. Accordingly

- Workers shall not be paid less than the wages determined by the Commission, and no provision contrary to this shall be included in labour contracts and collective bargaining agreements. Any such provision shall be deemed null and void.

- No deduction shall be made from the minimum wage in Turkey due to the social benefits provided to the workers by the employers.

Another point to be considered regarding the minimum wage is that the minimum wage tariffs determined by some professional organisations (chambers of engineers, bar associations or the Turkish Medical Association, etc.) are binding only on these professionals, and are not binding on third parties, namely employers. Accordingly, when an engineer, workplace physician or lawyer will be employed with an employment contract, the wage can be determined entirely depending on the bargaining power of the parties.

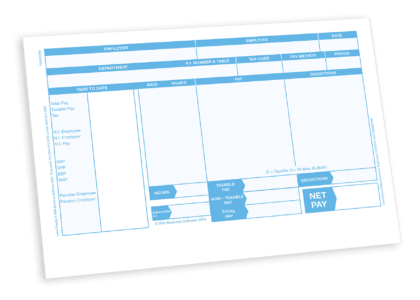

Wage Statement

According to Article 37 of the Law No. 4857, employers are obliged to give the employee a signed compass showing the wage account and bearing the special mark of the workplace in the payment they make at the workplace or to the bank. Contrary to the practice, this compass must bear the signature of the employer and the special mark of the workplace.

In this document

- The day of payment and the period to which it relates

- The amount of add-ons such as overtime, week holiday, holiday and general holiday wages

- Deductions such as insurance premium, income tax, advance payment, alimony and execution

They must be shown separately.