Provisional Article 6 of the Labour Law No. 4857 stipulates that a severance pay fund will be established for severance pay in Turkey, and until the relevant law enters into force, severance pay rights will be reserved according to Article 14 of the Labour Law No. 1475. In other words, severance pay is still in force. Therefore, according to this provision, severance pay will have to be paid to the workers in case of entitlement.

According to Article 14 of the Labour Law No. 1475, which is still in force, certain conditions must be met in order to be entitled to severance pay in Turkey :

– The seniority of the employee must complete one year in one workplace or in different workplaces of the same employer. The concept of year here should be understood as 365 days.

– The employment contract must be terminated for certain reasons:

1. The termination of the employment contract by the employer for reasons other than Article 25, Article II according to the new law, (it is also necessary to refer to Articles 23, 68, 70 and 72 of the Law No. 6356 on Trade Unions and Collective Labour Agreements. This issue is explained separately below).

2. In case the employment contract is terminated by the employee in accordance with Article 24 of the new law,

3. Where the employment contract was terminated by the employee due to active military service,

4. If the employment contract is terminated by the employee for the purpose of receiving old age, pension or invalidity pension or lump sum payment from the institutions or funds established by the law to which the employee is affiliated,

5. In the event that the employment contract is terminated even though an application for an old-age pension has been made in accordance with the amendments made to the Social Insurance Law, but the age requirement for the pension has not yet been fulfilled,

(In this case, the transition periods to be considered according to the change in social insurance legislation and the conditions regarding the insurance period and the minimum number of premium payment days must be fulfilled. Accordingly If the worker was employed for the first time before 07.09.1999 (including this date), the conditions to be fulfilled are to have paid at least 3,600 days to be insured for at least 15 years.

Apart from this, if the worker was employed for the first time between 08.09.1999-30.04.2008 (including these dates), the minimum insurance period is 25 years and the minimum premium payment period is 4,500 days.

Finally, if the worker is employed for the first time after 01.05.2008 (including this date), the minimum number of premium payment days increases to 5,400 days, although the insurance requirement remains unchanged (25 years).

In this way, it is not considered as an abuse of the right for the workers who leave the workplace to start working in another workplace afterwards, to negotiate and even make a contract with the other workplace before leaving.

Again, in this way, in other words, if the employee who meets the other criteria for old age pension, except for age, leaves the workplace, the right to severance pay can be used only once. For example, when an employee who starts working in another workplace quits after one year for the same reason, the right to severance pay does not arise. However, if this employee leaves the workplace this time by fulfilling all the conditions, including age, and if other conditions, such as having worked for at least one year, are also fulfilled, he/she will be able to claim severance pay at his/her last employer).

6. If the employment contract ends with the voluntary resignation of the female employee within one year after her marriage, she will be entitled to severance pay in Turkey.

In relation to entitlement to severance pay in Turkey, it is also necessary to mention the relationship between severance pay and fixed-term employment contract. Because the fixed-term employment contract contains hesitations in the context of entitlement to severance pay. Accordingly

– In any termination of the fixed-term employment contract before the expiry of the term in a way to be entitled to severance pay (entitlement to old age pension, justified termination of the employee or unjustified termination of the employer, etc.), severance pay can be requested.

– Again, the employer’s notification that the fixed-term employment contract will not be renewed at the end of its term is also a situation that entitles the employee to severance pay. However, otherwise, if the employee is notified that the contract cannot be renewed, the right to severance pay does not arise.

– As in the Law No. 5580 on Private Education Institutions, if it is only required by law to make a fixed-term employment contract, the right to severance pay arises at the end of the term.

Apart from this provision, Articles 23, 68, 70 and 72 of the Law No. 6356 on Trade Unions and Collective Labour Agreements should also be mentioned in the context of the right to severance pay.

Article 23 of the aforementioned Law regulates the guarantees for the management of workers’ organisations (trade unions and confederations). According to this provision, the employment contract of the employee who leaves his/her workplace due to being a manager in a workers’ organisation will remain suspended, and the manager may terminate the employment contract on the date of leaving the workplace without complying with the notice period or without waiting for the end of the contract period and will be entitled to severance pay. In the event that the manager terminates the employment contract during the management period, the severance pay will be calculated based on the imputed wage on the date of termination. Again, according to the provision of the article, if the manager wishes to return to work after the termination of the managerial duty, the employer is obliged to employ this person. In this case, if the employer does not employ the manager, the employment contract is deemed to have been terminated by the employer. Finally, in the event of the termination of the executive’s duty for a reason other than the termination of the legal entity of the union, not running for election, not being re-elected, or the termination of his/her duty by withdrawing voluntarily, the union executive will be paid severance pay by the employer upon their application. In the calculation of the severance pay to be paid, the periods worked in the workplace will be taken into consideration and the wages and other rights valid for their peers at the time of termination will be taken as basis. The rights of the employee arising from labour laws shall remain reserved.

Article 68 contains the provisions on the prohibition of recruitment and employment in case of strike and lockout. Accordingly, workers whose employment contracts are suspended due to a legal strike and lockout cannot work for another employer during the strike and lockout. Otherwise, their employment contracts may be terminated by the employer for just cause. In this case, the right to severance pay in Turkey will not arise. However, even in this case, the employment contracts of the employees working with part-time employment contracts cannot be terminated for just cause, since it is allowed to work for another employer for a period not exceeding the legal weekly working time. Accordingly, for example, an employee who works with a part-time employment contract that stipulates 30 hours of work per week at the workplace is given the opportunity to work at another workplace for 15 hours a week, not exceeding 45 hours, and justified termination arises if the time spent in this other job is more than 15 hours per week.

Article 70 of the Law regulates the consequences of illegal strikes and lock-outs and stipulates that in the event of an illegal strike, the employer may terminate the employment contracts of the employees who participate in the decision to strike, encourage the strike, participate in the strike or encourage the participation or continuation of the strike for just cause. In this case, it is clear that the workers will not be entitled to severance pay. In the opposite case, in other words, if there is an illegal lockout, it is stipulated that the employees may terminate their employment contracts for just cause. This shows that workers will be entitled to severance pay if they terminate their employment contracts in this way.

Article 72 of Law No. 6356 regulates the abuse of the right to strike and lockout. According to the aforementioned article, if it is determined by a finalised court decision that a legal lockout is carried out for the purpose of keeping the workplace permanently closed, the lockout may be suspended. However, if the lockout is continued, the workers have the right to benefit from the provisions of Article 70, in which case it becomes possible for the workers to terminate their employment contracts for just cause. In this case, workers will be entitled to severance pay in Turkey.

The amount of severance pay is 30 days’ wage of the worker for each year. This period can be increased by employment contracts or collective labour agreements.

In the calculation of severance pay in Turkey, each 365-day period is accepted as one year. Periods exceeding 365 days are reflected in the severance pay by making a proportion.

In the calculation of severance pay, not the naked wage paid to the employee, but the dressed wage should be taken as the basis, and also the benefits that are paid continuously and periodically (bonuses, premiums on sales, meal and travel allowances, etc.) should be taken into account. However, incidental benefits such as overtime work, premium in the sense of reward and similar benefits will be ignored.

The last monthly wage should be taken as basis in the calculation of severance pay. However, if the wage is paid according to piece, lump sum, lump sum or percentage method, the wage subject to severance pay should be calculated on the average wage to be obtained by dividing the wages earned in the last year by the days worked in the last year. If the employee’s wage has been increased within the last year, then the calculation should be made by dividing the wages earned between the date of leaving the job and the date of the increase by the days worked in the same period.

When calculating the severance pay according to these issues, for example, the number of days based on seniority for an employee who has worked for 3 years, 5 months and 12 days should be calculated as 1095 for 3 years, 150 for 5 months and 1257 days including 12 days, and then the monthly earnings (daily earnings should be multiplied by 30 days) based on the calculation of the severance pay should be divided by the number 365 and this amount should be multiplied by the number 1257 and the result should be reached.

In part-time employment, according to the Labour Law No. 4857 on this subject, since no difference can be made between part-time and full-time employees, severance pay will have to be calculated and paid according to the principle explained above, just like full-time employees.

The only tax deduction to be made from severance pay is stamp tax. Apart from this, there is no need to deduct income tax and insurance premium.

Again, if the amount to be found by calculating the severance pay exceeds the severance pay ceiling, the payment should be made based on the ceiling.

More than one severance payment should not be made for the same period.

It is essential that the severance pay in Turkey calculated in this way is paid in advance at the termination of the contract.

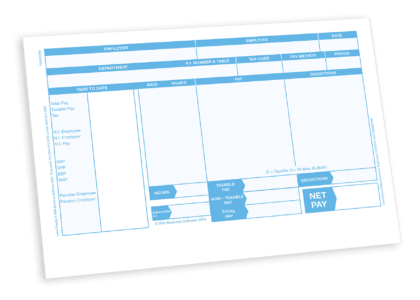

In severance pay payments, a payroll must be prepared and the signature of the employee must be obtained at the time of payment. If a release is to be given by the employee, care should be taken to ensure that these documents meet the content and form requirements specified in Article 420 of the Code of Obligations. Otherwise, this document becomes null and void and has no force.