Article 1 of the Unemployment Insurance Law No. 4447 defines the wage guarantee fund in Turkey application in order to guarantee the wages in case the employer becomes insolvent and a regulation is envisaged to be issued in this regard. The said regulation was published in the Official Gazette dated 28.06.2009 and numbered 27272 under the name of Wage Guarantee Fund in Turkey Regulation and entered into force.

According to the aforementioned article of the law, a separate wage guarantee fund in Turkey will be established within the scope of the unemployment insurance fund in order to cover the three-month unpaid wage receivables of the workers arising from the labour relationship in order to be valid in cases where the employer, who employs the persons considered insured according to the aforementioned law with an employment contract, declares concordat in general terms, obtains a certificate of insolvency for the employer, bankruptcy or postponement of bankruptcy and the employer falls into insolvency.

In the payments to be made within this scope, the payment will be made on the basis of the basic wage based on the condition that the employee has worked in the same workplace within the last year before the employer’s insolvency. The payment amount shall not exceed the upper limit of the earnings taken as basis for social security premiums.

According to Article 8 of the Regulation, the application to benefit from the wage guarantee fund in Turkey must be made personally by the employee, except for force majeure. In this case, in order for the wage receivable to be paid by the institution, regardless of whether the employment contract continues or not,

a. In the event that a certificate of insolvency is obtained about the employer, the certificate of insolvency obtained from the execution office or the attachment report stating that there is no attachable property to be taken in accordance with the first paragraph of Article 105 of the Execution and Bankruptcy Law dated 9.6.1932 and numbered 2004 and the employee receivable certificate issued by the employer,

b. In case of bankruptcy of the employer, the bankruptcy decision issued by the court or the document showing that the bankruptcy decision has been declared in accordance with Article 166 of the Law on Execution and Bankruptcy and the bankruptcy office or the worker’s low document approved by the bankruptcy office,

c. In case of postponement of the bankruptcy of the employer, the postponement of bankruptcy decision issued by the court or the document showing that the postponement of bankruptcy has been declared in accordance with Article 166 of the Execution and Bankruptcy Law and the employee receivable document approved by the trustee,

d. In the event that concordat is declared about the employer, the document showing that the concordat respite decision issued by the court or the negative respite decision has been declared in accordance with Article 288 of the Enforcement and Bankruptcy Law and the certificate of labour receivable approved by the concordat commissioner will be submitted to the institution unit.

Additionally, according to the provisional Article 2 of the regulation, in the applications made to the institution before the effective date (30.09.2021), if the employer is declared concordat, the temporary respite decision issued by the court will also be taken as a basis for payments.

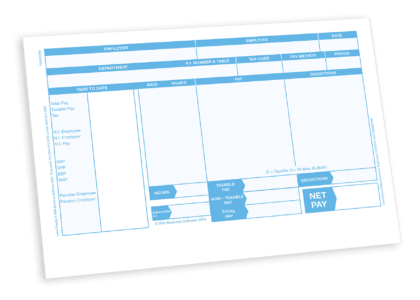

According to Article 9 of the Regulation, in order to make a payment, the wage receivable document, the format of which will be determined by the institution, which will be issued by the employer and given to the employee, is expected to be related to wage receivables prior to the date of the employer’s insolvency. It is accepted as a basis to declare net wages with this document. In the event that the employer cannot be reached in the determination of the wage receivable, if the finalized court decision stating the wage receivable in terms of period and amount or the payment order issued by the execution directorate is submitted to the institution by the applicants, these documents will replace the employee receivable document. Again, in order to be eligible for payment within the scope of the wage guarantee fund in Turkey, the employee must have worked at least one day in the same workplace within the scope of the Unemployment Law No. 4447 within the last year before the employer’s insolvency.

According to the same article, the daily wage claim shall not exceed the upper limit of daily earnings determined in accordance with Article 82 of the Law No. 5510 and the wage claim shall be paid until the end of the month following the date of application of the worker to the institution. Payments to be made within this scope are limited to fund resources and payments will be made according to the application to the institution.

Again according to the same article;

In labour relations with the same employer, it is possible to benefit from the fund only once based on the sequestration report, which is a certificate of insolvency within the scope of the first paragraph of Article 105 of the Execution and Bankruptcy Law No. 2004.

In suspicious cases such as the fact that the wage receivable related to a different application has been paid within the scope of the fund in the one-year period prior to the date of falling into insolvency subject to the application, receiving information that the requested wage receivable has been paid by the employer, or reporting the monthly amount of the requested wage receivable significantly higher than the previous period wages, the procedures regarding the application will be finalised following the examination to be carried out by the audit staff specified in the fourth paragraph of Article 52 of the Law No. 4447.

The amount of national holiday, general holiday, week holiday and paid holiday wage receivables and overtime wage receivables, which have been reported to the Social Security Institution and which are entitled without working, will be evaluated within the scope of the fund.

In cases where the wage is determined in foreign currency in the employment contract, the payment will be made based on the effective foreign exchange sales rate determined by the Central Bank of the Republic of Turkey on the last day of the period in which the employee’s wage receivable is due.

In the event that the decision or document based on insolvency is terminated or cancelled by a final court decision, the payments made will be collected from the employer with legal interest, and the overpayments or improper payments determined to be caused by the intention or fault of the employee or the employer will be collected from those concerned with legal interest.

Payments made according to the final respite or temporary respite decision before the effective date of this paragraph (30.09.2021) will be collected in the context of the previous regulation in the event that the respite decision is lifted/removed for a reason other than the approval of the concordat or bankruptcy decision. In cases where the concordat request does not result in a bankruptcy decision, the date of the bankruptcy decision shall be taken as the date of insolvency and a maximum of 90 days of payments shall be made to the same person in total based on the concordat final respite decision and the bankruptcy decision.

If the concordat project is approved by the court, no payment will be made under the fund.